-

In today’s era of rapid cloud adoption, the biggest challenge for enterprises is no longer how to move to the cloud, but whether cloud and technology investments are actually delivering business value. Cost Saving alone is not enough to support long-term growth or sustained innovation. This is where FinOps (Financial Operations) becomes essential.

FinOps is not just about reducing cloud costs. It is a discipline and operating model that integrates financial accountability, engineering practices, and cross-functional collaboration to maximize the business value of cloud and technology spend (Value Realization).

FinOps is a modern financial management discipline that brings Finance, Engineering, and Business teams into a shared decision-making loop to enable data-driven cloud and technology spending.

The core principles of FinOps include:

-

Delegate financial accountability to engineering teams

-

Balancing speed, cost, and quality

-

Making every unit of cloud and technology spend understandable, forecastable, and measurable in terms of value

-

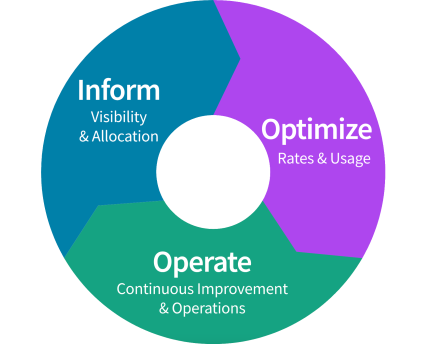

Inform – Establish cost visibility, allocation, and accountability

-

Optimize – Improve efficiency and eliminate waste

-

Operate – Embed FinOps into day-to-day operations and governance

This continuous loop allows FinOps to evolve alongside products and business growth.

FinOps and Cost Saving: Savings Are the Outcome, Not the Goal

Many organizations mistakenly equate FinOps with aggressive cost cutting. In reality, Cost Saving is an outcome of FinOps—not its primary purpose.

With FinOps, organizations systematically remove cloud waste that does not generate business value, using practices such as:

-

Accurate cost allocation and showback/chargeback

-

Rightsizing resources such as compute, memory, and storage

-

Leveraging commitment-based discounts such as Reserved Instances and Savings Plans

-

Establishing cloud governance policies and principles

These practices commonly deliver 20–30% reductions in unnecessary cloud spend. More importantly, FinOps changes team behavior—engineering teams naturally consider unit economics and efficiency during design and architecture decisions, rather than reacting after costs escalate.

Without FinOps, cloud budgets often turn into post-mortems explaining why spending exceeded expectations. FinOps transforms Forecasting into a collaborative, manageable capability.

FinOps-driven cloud forecasting typically includes:

-

Combining historical usage data and growth assumptions

-

Involvement from Engineering, Finance, and Leadership

-

Forecasts treated as financial expectations that teams actively manage and explain

-

Improve forecast accuracy and predictability

-

Identify anomalies and risks early

-

Support usage planning and investment decisions

Value Realization is the true destination of FinOps.

FinOps requires organizations to answer not only “How much did we spend?” but more importantly: “What business value did this cloud or technology spend generate?”

A value-driven FinOps approach typically includes:

-

Defining business outcome-aligned metrics such as:

-

Cost per transaction

-

Cost per customer

-

Product margin and unit economics

-

-

Mapping cloud and technology costs to products, features, or business units

-

Prioritizing high-ROI, high-impact workloads

-

Early retirement of low-value or underperforming consumption-based resources

This visibility enables leaders to clearly decide which investments should be scaled up, optimized, or discontinued to maximize ROI.

Within the FinOps framework, these three capabilities are deeply interconnected:

-

Cost saving results from targeted optimization actions

-

Forecasting provides the financial signals and expectations

-

Value realization ensure savings are reinvested into high-value initiatives

As FinOps maturity grows, organizations typically progress through three stages:

-

Reduce Spend – Eliminate waste

-

Shape Spend – Direct spending toward strategic priorities

-

Optimize Unit Economics and Portfolio Value – Maximize ROI across resources and investments

This evolution is what differentiates FinOps from traditional IT cost management.

FinOps Is a Competitive Advantage, Not a Finance Exercise

The value of FinOps lies not in tools or dashboards, but in how it reshapes organizational thinking about cloud and technology spend. When enterprises successfully integrate Cost Saving, Forecasting, and Value Realization, the cloud is no longer an uncontrollable cost center—it becomes a strategic engine for growth and innovation.